By Kyle Linzer

The question of the supposed simplicity and fairness of a flat tax keeps popping up every few years in political debate, most recently with the plans of Cain and now Perry. I just wanted to look at what this kind of flat tax would look like for people across the income range to see how fair and simple it would be. One question needs to be addressed before we can begin to look at real numbers. How much needs to be spent every month to meet the requirements of what the majority of people would consider to be necessities? How much do we need to pay our rent/mortgage, utilities, food, clothing, medical expenses, etc.? Let’s say we need a minimum of $1,000.00 each month for these basic necessities. Before you say “$1,000 a month, that is way too…” Were you going to say large a sum, or small? Though this is an argument that should be addressed, perhaps we can save it for another article and agree to use the figure of $1,000.00 per month for now. Let us also add that half of that money will be used for non-taxable expenses such as rent/mortgage and half would be taxable by a flat tax similar to sales tax.

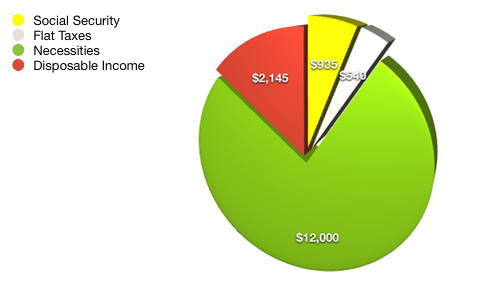

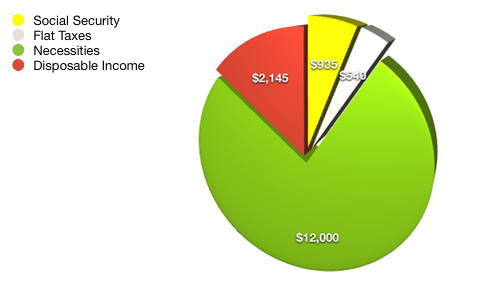

On to real people (Fig. 1). A person working for minimum wage, $7.25 per hour, for 40 hours per week, for 52 weeks per year with no vacation days, no days sick, no extra days off (did I say a real person?) would earn before any deductions $15,080 per year. Just for the sake of comparison, we are only going to take out social security, leaving all other income for the person making minimum wage. Taking out the employee contribution to social security at 6.2% a total of $935 leaves this person $14,145 for the year. Necessities, remember, are $1,000 per month, $12,000 per year, leaving this person with $2,145 to be spent on non-necessities. But remember that half of the $12,000 used for necessities are taxable, so $6,000 is taxable. Let’s use Cain’s tax rate of 9%. This means that the person making minimum wage will pay $540 in taxes. Of the $2,145 that someone working 40 hours per week, 52 weeks per year, has left to spend, $540 of it goes to taxes, for a tax rate of 25% on their income after necessities are paid.

Fig. 1: A person making $15,080 per year

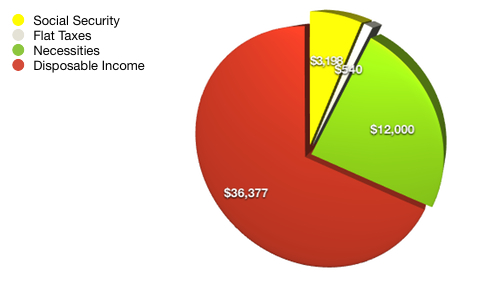

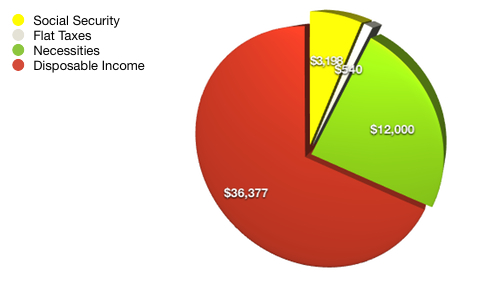

On to other real people (Fig. 2), the average American. According to the US census, the average median income of employees in all states in the US is $51,575. So a person making this salary would pay 6.2% social security taxes (unless self employed) or $3,198 per year, leaving the average American worker with $48,377 to spend per year. Again, for the sake of simple comparison, assuming that necessities constitute $1,000 per month, half of which are taxable, yields $540 in taxes and an income of $36,377 after necessities and Social Security are paid. So the average American will pay a tax rate of approximately 1.5%.

Fig. 2: A person making $51,575 per year

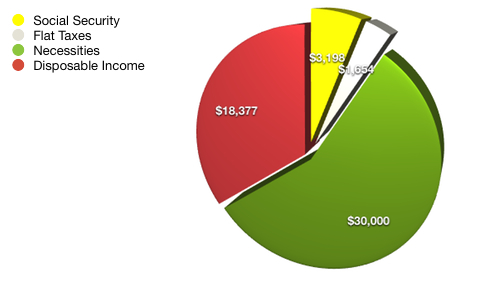

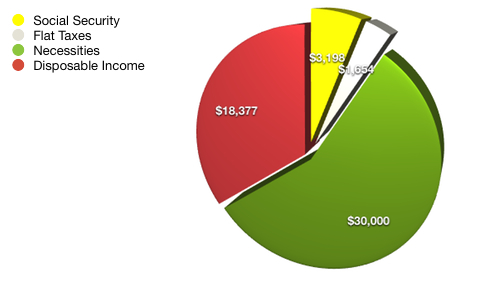

But, you say, the average American needs to spend a great deal more on “necessities”. Ok, let’s run the numbers again (Fig. 3) assuming that the average American needs to spend $2,500 per month on necessities, or 2.5 times that of someone making minimum wage. (Of course if that is true, those working 40 hours per week, 52 weeks per year making minimum wage fall far short of what is considered to be the income necessary to live. This, as mentioned earlier, is an argument that needs to be explored in depth in another article). In this case, the average American still has $48,377 to spend per year, but $30,000 goes to necessities, leaving $18,377 for non-essentials and $1,654 in taxes at Cain’s 9% for a tax rate of 9%.

Fig. 3: A person making $51,575 per year (higher "necessities")

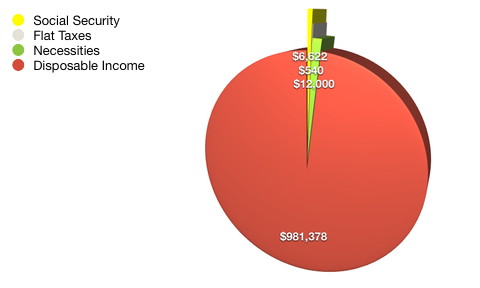

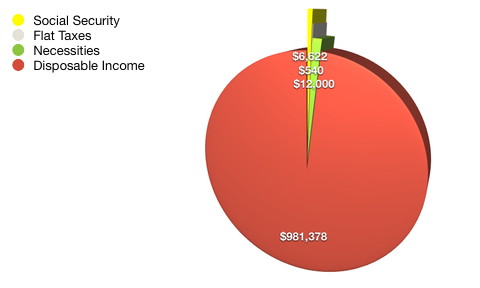

On to other real people (Fig. 4), those making $1,000,000 per year. Again taking out social security at 6.2%, or $62,000… Wait, did I say $62,000? According to the Social Security administration, deductions are capped at $106,800 per year. So a person making $1,000,000 per year only pays $6,622 in social security taxes per year, for a rate of .6622% whereas the person making minimum wage and the average American both pay at least 6.2%. Though this doesn’t seem fair or simple to me, it is, alas, also an argument for another article. Back to our earner of $1,000,000 per year. Taking out $6,622 for social security and $12,000 for necessities, half of which are taxable, this person is left with $981,378 for the year, of which $540 goes to taxes for a rate of .055%

Fig. 4: A person making $1,000,000 per year

So spending the same amount of money and taxed at the same rate (a flat or sales tax) someone making minimum wage pays an effective rate of 25%, the average American pays an effective rate of 1.5%, and someone making $1,000,000 per year pays an effective rate of .055%.

But again you say to expect someone making $1,000,000 a year to spend $1,000 a month on necessities is absurd. Alright, I agree. Let us have this person spend each month on necessities what the person making minimum wage makes in an entire year ($15,080) and run the numbers again (Fig.

5). I know, to argue that anyone needs to spend $15,080 a month on necessities in order to live is one that still needs to be made, but let us again leave that for a future article. So the person making $1,000,000 per year, paying $6,622 for social security, and $180,960 for necessities, is left with $812,418. From this we must take taxes at 9% of $90,480, half of what was spent on necessities. This yields taxes of $8,143 for the year for a rate of 1%.

Fig. 5: A person making $1,000,000 per year (higher "necessities")

So spending on necessities $1,000 per month for someone earning minimum wage, $2,500 per month for the average American, and $15,080 per month for someone earning $1,000,000 per year, paying taxes at a flat rate of 9%, the effective tax rate is 25% for the poorest Americans, 9% for the average Americans, and 1% for the wealthy.

I don’t see how this can be simple, fair, or balanced. But I am not an economist, a politician, a political scientist, an expert, or a magician. I am just a relatively intelligent person, a voter, and someone who can do math. If anyone can point out to me mistakes in the math or approach, I would be happy to hear them and revise my thinking. But it doesn’t take an expert to know there is something wrong with a flat tax system for any but the wealthiest of Americans.

On to real people (Fig. 1). A person working for minimum wage, $7.25 per hour, for 40 hours per week, for 52 weeks per year with no vacation days, no days sick, no extra days off (did I say a real person?) would earn before any deductions $15,080 per year. Just for the sake of comparison, we are only going to take out social security, leaving all other income for the person making minimum wage. Taking out the employee contribution to social security at 6.2% a total of $935 leaves this person $14,145 for the year. Necessities, remember, are $1,000 per month, $12,000 per year, leaving this person with $2,145 to be spent on non-necessities. But remember that half of the $12,000 used for necessities are taxable, so $6,000 is taxable. Let’s use Cain’s tax rate of 9%. This means that the person making minimum wage will pay $540 in taxes. Of the $2,145 that someone working 40 hours per week, 52 weeks per year, has left to spend, $540 of it goes to taxes, for a tax rate of 25% on their income after necessities are paid.

Fig. 1: A person making $15,080 per year

On to other real people (Fig. 2), the average American. According to the US census, the average median income of employees in all states in the US is $51,575. So a person making this salary would pay 6.2% social security taxes (unless self employed) or $3,198 per year, leaving the average American worker with $48,377 to spend per year. Again, for the sake of simple comparison, assuming that necessities constitute $1,000 per month, half of which are taxable, yields $540 in taxes and an income of $36,377 after necessities and Social Security are paid. So the average American will pay a tax rate of approximately 1.5%.

Fig. 2: A person making $51,575 per year

But, you say, the average American needs to spend a great deal more on “necessities”. Ok, let’s run the numbers again (Fig. 3) assuming that the average American needs to spend $2,500 per month on necessities, or 2.5 times that of someone making minimum wage. (Of course if that is true, those working 40 hours per week, 52 weeks per year making minimum wage fall far short of what is considered to be the income necessary to live. This, as mentioned earlier, is an argument that needs to be explored in depth in another article). In this case, the average American still has $48,377 to spend per year, but $30,000 goes to necessities, leaving $18,377 for non-essentials and $1,654 in taxes at Cain’s 9% for a tax rate of 9%.

Fig. 3: A person making $51,575 per year (higher "necessities")

On to other real people (Fig. 4), those making $1,000,000 per year. Again taking out social security at 6.2%, or $62,000… Wait, did I say $62,000? According to the Social Security administration, deductions are capped at $106,800 per year. So a person making $1,000,000 per year only pays $6,622 in social security taxes per year, for a rate of .6622% whereas the person making minimum wage and the average American both pay at least 6.2%. Though this doesn’t seem fair or simple to me, it is, alas, also an argument for another article. Back to our earner of $1,000,000 per year. Taking out $6,622 for social security and $12,000 for necessities, half of which are taxable, this person is left with $981,378 for the year, of which $540 goes to taxes for a rate of .055%

Fig. 4: A person making $1,000,000 per year

So spending the same amount of money and taxed at the same rate (a flat or sales tax) someone making minimum wage pays an effective rate of 25%, the average American pays an effective rate of 1.5%, and someone making $1,000,000 per year pays an effective rate of .055%.

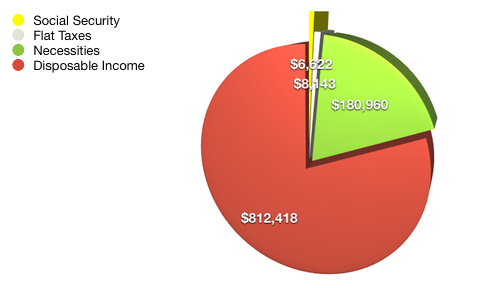

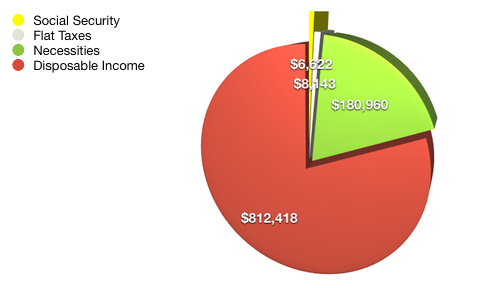

But again you say to expect someone making $1,000,000 a year to spend $1,000 a month on necessities is absurd. Alright, I agree. Let us have this person spend each month on necessities what the person making minimum wage makes in an entire year ($15,080) and run the numbers again (Fig.

5). I know, to argue that anyone needs to spend $15,080 a month on necessities in order to live is one that still needs to be made, but let us again leave that for a future article. So the person making $1,000,000 per year, paying $6,622 for social security, and $180,960 for necessities, is left with $812,418. From this we must take taxes at 9% of $90,480, half of what was spent on necessities. This yields taxes of $8,143 for the year for a rate of 1%.

Fig. 5: A person making $1,000,000 per year (higher "necessities")

So spending on necessities $1,000 per month for someone earning minimum wage, $2,500 per month for the average American, and $15,080 per month for someone earning $1,000,000 per year, paying taxes at a flat rate of 9%, the effective tax rate is 25% for the poorest Americans, 9% for the average Americans, and 1% for the wealthy.

I don’t see how this can be simple, fair, or balanced. But I am not an economist, a politician, a political scientist, an expert, or a magician. I am just a relatively intelligent person, a voter, and someone who can do math. If anyone can point out to me mistakes in the math or approach, I would be happy to hear them and revise my thinking. But it doesn’t take an expert to know there is something wrong with a flat tax system for any but the wealthiest of Americans.

No comments:

Post a Comment